The Definitive Guide to Feie Calculator

Table of ContentsWhat Does Feie Calculator Mean?8 Easy Facts About Feie Calculator DescribedThe 9-Second Trick For Feie CalculatorFascination About Feie CalculatorWhat Does Feie Calculator Do?More About Feie CalculatorFeie Calculator - The Facts

If he 'd often taken a trip, he would instead finish Component III, detailing the 12-month period he satisfied the Physical Existence Test and his travel history - American Expats. Step 3: Reporting Foreign Income (Part IV): Mark earned 4,500 monthly (54,000 each year). He enters this under "Foreign Earned Earnings." If his employer-provided real estate, its worth is likewise included.Mark calculates the exchange rate (e.g., 1 EUR = 1.10 USD) and transforms his income (54,000 1.10 = $59,400). Given that he lived in Germany all year, the percentage of time he stayed abroad throughout the tax obligation is 100% and he enters $59,400 as his FEIE. Finally, Mark reports complete salaries on his Form 1040 and gets in the FEIE as an adverse amount on Schedule 1, Line 8d, lowering his taxed income.

Choosing the FEIE when it's not the best choice: The FEIE might not be suitable if you have a high unearned income, earn greater than the exemption limit, or reside in a high-tax nation where the Foreign Tax Credit (FTC) might be more useful. The Foreign Tax Obligation Credit Scores (FTC) is a tax obligation reduction method commonly utilized combined with the FEIE.

The 30-Second Trick For Feie Calculator

deportees to offset their U.S. tax debt with international income taxes paid on a dollar-for-dollar reduction basis. This indicates that in high-tax nations, the FTC can often remove U.S. tax financial debt entirely. The FTC has restrictions on qualified taxes and the optimum insurance claim amount: Qualified tax obligations: Only earnings taxes (or taxes in lieu of revenue taxes) paid to international federal governments are eligible (American Expats).

tax obligation on your foreign earnings. If the international tax obligations you paid exceed this limitation, the excess international tax obligation can usually be continued for as much as 10 years or returned one year (through a modified return). Maintaining precise documents of international earnings and tax obligations paid is therefore important to calculating the correct FTC and keeping tax obligation compliance.

migrants to decrease their tax obligations. If a United state taxpayer has $250,000 in foreign-earned income, they can omit up to $130,000 making use of the FEIE (2025 ). The staying $120,000 might after that undergo tax, but the united state taxpayer can possibly use the Foreign Tax Credit score to counter the taxes paid to the foreign nation.

Not known Details About Feie Calculator

He marketed his U.S. home to establish his intent to live abroad permanently and applied for a Mexican residency visa with his better half to assist accomplish the Bona Fide Residency Examination. Neil points out that acquiring residential property abroad can be testing without first experiencing the location.

"We'll most definitely be beyond that. Even if we come back to the United States for physician's visits or organization calls, I question we'll invest greater than thirty days in the United States in any offered 12-month duration." Neil emphasizes the importance of strict tracking of U.S. brows through. "It's something that people require to be actually persistent concerning," he says, and recommends expats to be cautious of typical errors, such as overstaying in the U.S.

Neil takes care to stress to U.S. tax authorities that "I'm not performing any type of organization in Illinois. It's just a mailing address." Lewis Chessis is a tax expert on the Harness platform with extensive experience helping united state people browse the often-confusing realm of international tax obligation conformity. Among the most usual mistaken beliefs among U.S.

9 Simple Techniques For Feie Calculator

tax return. "The Foreign Tax Credit score enables people operating in high-tax countries like the UK to counter their united state tax obligation obligation by the amount they've currently paid in taxes abroad," states Lewis. This guarantees that deportees are not taxed two times on the same earnings. Those in reduced- or no-tax countries, such as the UAE or Singapore, face added hurdles.

The possibility of lower living costs can be appealing, yet it often comes with compromises that aren't instantly apparent - https://feiecalcu.carrd.co/. Real estate, for instance, can be extra inexpensive in some countries, but this can imply jeopardizing on facilities, safety and security, or access to reputable utilities and services. Cost-effective residential properties could be found in areas with irregular web, limited public transportation, or unstable medical Going Here care facilitiesfactors that can dramatically influence your everyday life

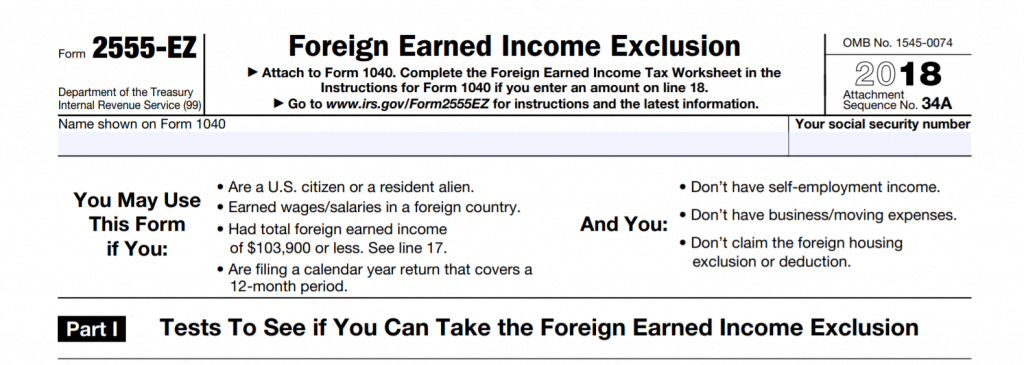

Below are some of the most often asked concerns concerning the FEIE and other exclusions The Foreign Earned Income Exclusion (FEIE) permits U.S. taxpayers to leave out as much as $130,000 of foreign-earned income from government income tax obligation, decreasing their united state tax responsibility. To certify for FEIE, you should meet either the Physical Existence Test (330 days abroad) or the Authentic Home Examination (verify your primary residence in an international country for an entire tax year).

The Physical Visibility Test also needs U.S. taxpayers to have both an international earnings and a foreign tax obligation home.

The 10-Minute Rule for Feie Calculator

An earnings tax treaty between the united state and one more nation can aid prevent double taxation. While the Foreign Earned Income Exclusion decreases gross income, a treaty may supply added advantages for eligible taxpayers abroad. FBAR (Foreign Savings Account Report) is a required declaring for U.S. residents with over $10,000 in foreign monetary accounts.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax consultant on the Harness platform and the owner of The Tax obligation Man. He has more than thirty years of experience and currently specializes in CFO services, equity payment, copyright taxation, marijuana taxes and separation associated tax/financial planning matters. He is an expat based in Mexico.

The foreign earned income exemptions, often referred to as the Sec. 911 exclusions, exclude tax obligation on incomes earned from working abroad. The exemptions consist of 2 parts - an income exclusion and a housing exclusion. The following Frequently asked questions review the benefit of the exemptions consisting of when both spouses are deportees in a basic way.

The Best Strategy To Use For Feie Calculator

The tax obligation advantage leaves out the earnings from tax at bottom tax obligation rates. Previously, the exemptions "came off the top" minimizing revenue subject to tax at the top tax rates.

These exclusions do not excuse the earnings from United States tax yet just give a tax obligation decrease. Keep in mind that a single person working abroad for every one of 2025 that gained concerning $145,000 without various other earnings will have gross income decreased to absolutely no - effectively the exact same response as being "free of tax." The exemptions are computed every day.

If you attended service conferences or workshops in the US while living abroad, revenue for those days can not be excluded. Your salaries can be paid in the US or abroad. Your company's place or the location where wages are paid are not aspects in getting approved for the exemptions. Foreign Earned Income Exclusion. No. For United States tax it does not matter where you keep your funds - you are taxable on your worldwide revenue as an US person.

Comments on “All About Feie Calculator”